- The Foreign Tax Credit (FTC) in Tunisia offers a financial relief mechanism, allowing residents to offset foreign taxes against Tunisian tax liabilities, fostering international trade and investment.

- Businesses, like a French tech startup in Tunis, can benefit from the FTC to ease cross-border tax burdens and encourage further international expansion.

- Leveraging the FTC requires careful tracking of foreign taxes, compliance with tax treaties, and navigation of complex regulations, highlighting the need for meticulous attention to detail.

- Mastering the FTC can lead to substantial financial growth and cement Tunisia’s position as a strategic hub in the African and Mediterranean business landscape.

- Tunisia’s FTC represents a significant opportunity for entrepreneurs, acting as a catalyst for international prosperity and economic expansion.

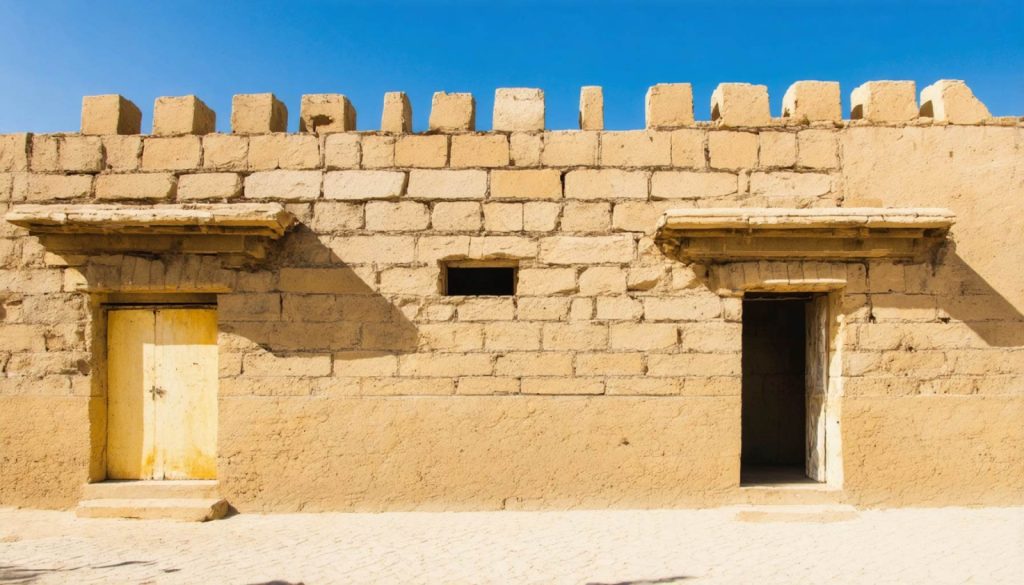

Amid the bustling souks of Tunisia, where vibrant colors and tantalizing aromas captivate the senses, lies an unexpected realm of global opportunity for discerning investors and intrepid entrepreneurs. The Foreign Tax Credit (FTC) stands like a well-kept secret, poised to soften the financial challenges many face when engaging in cross-border business ventures.

The FTC, a relief tool endorsed by Tunisia’s tax authorities, acts as a bridge between Tunisia and the world, fostering an environment ripe for international trade and investment. This mechanism allows Tunisian residents to offset taxes paid to foreign governments against their Tunisian tax liabilities. Such tax credits are lifelines for businesspeople who traverse borders, negotiating tariffs and expanding their enterprises.

Imagine a French entrepreneur, Amal, who has successfully launched a tech startup in Tunis. With dreams of going international, she opens a satellite office in Italy to tap into the European market. As profits flow in, Amal encounters Italy’s tax demands. However, Tunisia’s FTC eases her path, allowing her to claim a credit for the taxes paid in Italy. This not only smooths the tax burdens but also incentivizes Amal to further expand internationally, hinting at Tunisia’s strategic intent to position itself as a hub in the African and Mediterranean business landscape.

Yet, the journey to leveraging the FTC is akin to deciphering an ancient Tunisian tapestry—complex, intricate, but richly rewarding. Businesses and individuals must diligently track foreign taxes paid, ensure compliance with tax treaties, and adeptly navigate the myriad of regulations. Missing a single detail could mean the difference between significant savings and a costly mistake.

The takeaway is crystal clear: understanding and utilizing the Foreign Tax Credit in Tunisia is essential for any stakeholder involved in international affairs. It requires astute attention to detail, a proactive stance, and a willingness to delve into the nuanced layers of tax legislation. Nevertheless, once mastered, the FTC can propel financial growth and fortify Tunisia’s economic bonds globally.

As the sun sets over the shimmering Mediterranean, casting a golden hue over Tunis, the Foreign Tax Credit stands as a testament to Tunisia’s promise. It’s a beacon illuminating the path to international prosperity, urging entrepreneurs to embrace the challenge, unlock global doors, and thrive in a complex yet promising new world.

Unlocking the Global Market: How Tunisia’s Foreign Tax Credit Provides an Edge

Understanding Tunisia’s Foreign Tax Credit (FTC) and Its Global Impact

The Foreign Tax Credit (FTC) in Tunisia is not only a beneficial tax relief mechanism but also a critical element in supporting Tunisia’s strategic plan to emerge as a regional business hub. As global trade continues to expand, understanding how the FTC can mitigate financial burdens is essential for anyone involved in international commerce.

Key Aspects of the Foreign Tax Credit

– Eligibility and Application: To benefit from the FTC, Tunisian residents must demonstrate taxes paid to foreign governments and ensure these align with Tunisia’s tax treaties. The process involves meticulous record-keeping and clear documentation to claim credits successfully.

– Tax Treaty Networks: Tunisia has entered into multiple double taxation agreements with countries worldwide, which are designed to prevent citizens and businesses from being taxed twice on the same income. This network of treaties enhances the effectiveness of the FTC and encourages cross-border investments.

– Strategic Benefits: By offsetting foreign taxes, the FTC lowers the effective tax rate for companies operating internationally, thereby making investments in foreign markets more viable and less financially draining. This encourages Tunisian businesses to expand their horizons and engage more robustly in the global economy.

How-To Steps for Leveraging the FTC

1. Document Foreign Taxes: Keep detailed records of all taxes paid abroad. This documentation is crucial for claiming credits and ensuring compliance with legal requirements.

2. Consult Tax Experts: Engage with tax professionals familiar with Tunisian and international tax laws to navigate the complexities and maximize the benefits of the FTC.

3. Leverage Tax Treaties: Understand and utilize the double taxation treaties Tunisia has in place. These treaties can significantly ease the process of claiming foreign tax credits.

4. Regular Compliance Checks: Stay updated with changes in tax legislation both in Tunisia and the foreign jurisdiction. Regular compliance audits can prevent costly mistakes.

Real-World Use Cases and Insights

– Entrepreneurial Expansion: Entrepreneurs like Amal in the tech startup sector can utilize the FTC to reduce overall tax liabilities, enabling them to reinvest savings into scaling their businesses in new markets.

– Investment Advantages: For investors, understanding FTC can influence decisions on where to allocate resources, by giving preference to markets where tax credits can be claimed, thus increasing after-tax returns.

Market Trends and Prospects

– Rising Cross-Border Ventures: With globalization, many Tunisian businesses are looking beyond domestic markets. The FTC is a powerful tool that can catalyze this movement, making international ventures more financially attractive.

– Policy Evolution: As Tunisia continues to enhance its business environment, including possible updates to tax policies concerning the FTC, staying informed could provide a competitive edge.

Challenges and Limitations

Despite its advantages, utilizing the FTC can be complex:

– Regulatory Complexity: The diverse regulations across different countries can make tracking and claiming credits a daunting task.

– Dependence on Treaties: The FTC’s effectiveness is often contingent on the presence of a double taxation treaty, which may not exist with every country.

Final Recommendations

Unlock the potential of Tunisia’s Foreign Tax Credit by partnering with knowledgeable tax consultants, keeping abreast of international tax policies, and leveraging double taxation treaties where available.

Understanding and effectively using the FTC can lead to significant cost savings, providing the financial leeway necessary for international expansion and innovation.

For further insights into Tunisia’s business environment, you can explore the official website of Invest in Tunisia. Implement these strategies to make the most of global opportunities while maintaining strong economic ties back to Tunisia.