Table of Contents

- Executive Summary: Key Takeaways on Côte D’Ivoire’s Inflation Surge

- 2025 Inflation Projections: Latest Data from BCEAO and INS

- Historical Context: Inflation Patterns in Côte D’Ivoire (2015–2024)

- Root Causes: Domestic and Global Drivers Influencing 2025 Prices

- Impact on Households: Cost of Living, Food, and Basic Goods

- Business Implications: Strategic Risks and Opportunities

- Law & Tax: Regulatory and Fiscal Policy Updates from the Ministry of Economy and Finance

- Compliance: Monetary Policy Actions by BCEAO and Central Bank Mandates

- Key Statistics: GDP, CPI, and Inflation Benchmarks (Official Sources)

- Future Outlook: 2026–2030 Scenarios and Policy Recommendations

- Sources & References

Executive Summary: Key Takeaways on Côte D'Ivoire's Inflation Surge

Côte d’Ivoire has experienced significant inflationary pressures in recent years, driven by a combination of global and domestic factors. In 2023 and 2024, inflation spiked, primarily due to rising global commodity prices, supply chain disruptions, and the lingering effects of the COVID-19 pandemic. The government has responded with targeted fiscal and monetary policy interventions aimed at stabilizing prices and supporting vulnerable populations.

- Recent Inflation Trends: Inflation in Côte d’Ivoire reached a peak of approximately 5.7% in 2022, according to the Institut National de la Statistique. While pressures eased slightly in 2023, the annual inflation rate remained above the West African Economic and Monetary Union (WAEMU) convergence threshold of 3%. Food prices and energy costs have been the primary drivers of this inflation surge.

- Government Response and Regulations: The Ivorian government has implemented a series of price controls and subsidies on essential goods, alongside increased social spending, to mitigate the impact of inflation on low-income households. In addition, fiscal discipline measures and reforms under the WAEMU framework have been maintained to ensure macroeconomic stability (Ministère de l'Économie et des Finances).

- Compliance with Regional Standards: Côte d’Ivoire, as a member of WAEMU, is mandated to keep inflation below 3%. The recent breach of this threshold has prompted closer monitoring and policy adjustments, with authorities reaffirming their commitment to regional economic convergence criteria (Banque Centrale des États de l'Afrique de l'Ouest).

- Key Statistics: As of early 2024, monthly inflation rates have shown signs of deceleration, with the 12-month average trending toward 4.1%. Core inflation remains elevated due to persistent increases in housing and transport costs. Unemployment and underemployment, especially in urban areas, have tempered consumer demand, partially offsetting inflationary pressures (Institut National de la Statistique).

- Outlook for 2025 and Beyond: Forecasts from the Banque Centrale des États de l'Afrique de l'Ouest and national authorities suggest a gradual return to the WAEMU inflation target, contingent on global commodity prices stabilizing and the success of ongoing structural reforms. However, risks remain from external shocks and climate-related disruptions to agriculture.

Côte d’Ivoire’s inflation trajectory in 2025 will largely depend on both domestic policy effectiveness and global economic trends. Vigilant policy management and adherence to regional standards will be critical for sustained price stability.

2025 Inflation Projections: Latest Data from BCEAO and INS

In 2025, inflation trends in Côte d’Ivoire are drawing close scrutiny from both domestic authorities and regional institutions, reflecting a dynamic interplay of global price pressures and local economic policies. The main agencies providing oversight and data on inflation are the Institut National de la Statistique (INS) and the Banque Centrale des États de l'Afrique de l'Ouest (BCEAO). According to the latest consumer price index (CPI) reports from INS, inflation rates in early 2025 have moderated compared to the spikes experienced during the 2022–2023 global energy and food price surges. The year-on-year inflation rate stood at approximately 3.5% in the first quarter of 2025, slightly down from the 4.2% average recorded in 2023 (Institut National de la Statistique).

This moderation is partly attributed to timely fiscal interventions and monetary policy adjustments implemented by the BCEAO. In late 2023 and into 2024, BCEAO raised its key policy rates, aiming to counter imported inflation and stabilize the regional CFA franc. These tighter monetary conditions have carried over into 2025, supporting efforts to anchor inflation expectations and maintain price stability in Côte d’Ivoire and the broader West African Economic and Monetary Union (WAEMU) region (Banque Centrale des États de l'Afrique de l'Ouest).

On the legislative and compliance front, Côte d’Ivoire remains aligned with WAEMU’s convergence criteria, which mandate a maximum annual inflation rate of 3%. Although the 2025 rate slightly exceeds this threshold, government agencies are intensifying monitoring and compliance measures, particularly in sectors most affected by price volatility such as food, transport, and utilities. The Ministry of Economy and Finance has reinforced price controls on essential goods and increased market surveillance to prevent speculative practices (Ministère de l'Économie et des Finances).

Looking ahead to the next few years, projections from BCEAO suggest a gradual return to the WAEMU inflation target by 2026, contingent on global commodity price stabilization and continued prudent policy management. The authorities are also prioritizing supply chain resilience and diversification, aiming to cushion the economy against external shocks. While risks remain—especially from global energy markets and regional security challenges—the overall outlook for inflation in Côte d’Ivoire in 2025 and beyond is cautiously optimistic, underpinned by robust institutional frameworks and ongoing policy vigilance.

Historical Context: Inflation Patterns in Côte D'Ivoire (2015–2024)

Between 2015 and 2024, Côte d’Ivoire experienced significant shifts in its inflation patterns, shaped by both domestic policy and global economic dynamics. From 2015 through 2019, the country maintained relatively moderate inflation, with annual rates consistently below the West African Economic and Monetary Union (WAEMU) convergence criterion of 3%. This stability was supported by prudent monetary policy under the regional central bank, the Banque Centrale des États de l'Afrique de l'Ouest (BCEAO), and robust economic growth driven by agriculture, infrastructure development, and foreign investment.

However, the onset of the COVID-19 pandemic in 2020 disrupted supply chains, increased transportation costs, and caused currency pressures, leading to a gradual uptick in inflation. The inflation rate rose from 0.8% in 2019 to approximately 2.4% in 2020 according to the Institut National de la Statistique. Government interventions, including temporary subsidies and price controls on essential goods, helped prevent more severe price surges.

From 2021 onward, inflationary pressures intensified, particularly due to rising global food and energy prices, exacerbated by the Russia-Ukraine conflict in 2022. By 2022, inflation peaked at 5.2%, surpassing the WAEMU target and prompting the BCEAO to implement tighter monetary policy, including increasing the key interest rate from 2% to 2.5% in June 2022 (Banque Centrale des États de l'Afrique de l'Ouest).

Despite these measures, inflation remained above the target at 4.5% in 2023. The government reinforced compliance with anti-hoarding regulations, strengthened monitoring of price formation, and enhanced support to vulnerable households through targeted subsidies and social transfers (Ministère de l’Economie et des Finances).

- 2015–2019: Inflation rates stayed below 3%, ensuring macroeconomic stability.

- 2020: Inflation rose to 2.4% following pandemic-related disruptions.

- 2022: Inflation peaked at 5.2% due to external shocks and internal pressures.

- 2023: Inflation eased slightly to 4.5% but remained above the WAEMU threshold.

Looking toward 2025 and the next few years, the inflation outlook in Côte d’Ivoire is cautiously optimistic. The BCEAO projects a gradual return to the WAEMU convergence criterion, assuming global commodity prices stabilize and domestic supply chains recover. Continued fiscal discipline, compliance with regional monetary directives, and government support for food security and price stability are expected to anchor inflation expectations (Banque Centrale des États de l'Afrique de l'Ouest). However, risks remain from global market volatility and climate-related disruptions, necessitating vigilant policy adjustments.

Root Causes: Domestic and Global Drivers Influencing 2025 Prices

The inflation trends in Côte d’Ivoire for 2025 are shaped by a combination of domestic factors and global economic dynamics, with significant implications for price stability, policy responses, and legal compliance. As of early 2025, inflation in Côte d’Ivoire remains a central concern, following the moderate but persistent price increases seen in the preceding years. According to data from the Institut National de la Statistique, consumer price inflation averaged 4.8% in 2024, which was above the convergence criterion set by the West African Economic and Monetary Union (WAEMU) at 3%, and forecasts suggest a similar trajectory into 2025.

Several key domestic drivers are influencing these inflationary pressures. First, disruptions in the agricultural sector—Côte d’Ivoire’s main economic pillar—have led to supply shortages, particularly of cocoa and staple foods. Unseasonal weather patterns and input cost increases have amplified food price inflation, which accounts for over 40% of the consumer price index basket. Second, the implementation of new tax measures and adjustments in administered prices, such as fuel and electricity tariffs, have directly contributed to cost-push inflation—despite government efforts to cushion vulnerable populations through targeted subsidies and price controls, as mandated by the Ministère de l’Economie et des Finances.

On the global front, Côte d’Ivoire’s inflation outlook is impacted by volatility in global commodity markets. Fluctuations in international oil prices and import costs—driven by geopolitical tensions and supply chain disruptions—have exerted upward pressure on domestic prices, especially given the country’s reliance on imported refined products and capital goods. The depreciation of the CFA franc against major currencies has further heightened imported inflation, complicating the Central Bank’s efforts to maintain price stability through monetary policy in line with Banque Centrale des États de l’Afrique de l’Ouest guidelines.

- 2024 inflation: 4.8% (INS)

- Primary drivers: food supply shocks, energy/fuel price adjustments, new fiscal measures

- Global influences: commodity price swings, currency depreciation

- Policy threshold: WAEMU target 3% (persistent overshoot)

Looking ahead, official projections indicate that inflation may gradually moderate by late 2025, contingent on improved harvests, stable energy prices, and effective implementation of fiscal consolidation measures. However, the persistence of external risks and domestic supply constraints suggests that inflation may remain above the WAEMU target in the near term. Compliance with regional monetary policy frameworks and domestic price control laws will remain critical for mitigating inflationary effects on vulnerable groups and ensuring macroeconomic stability.

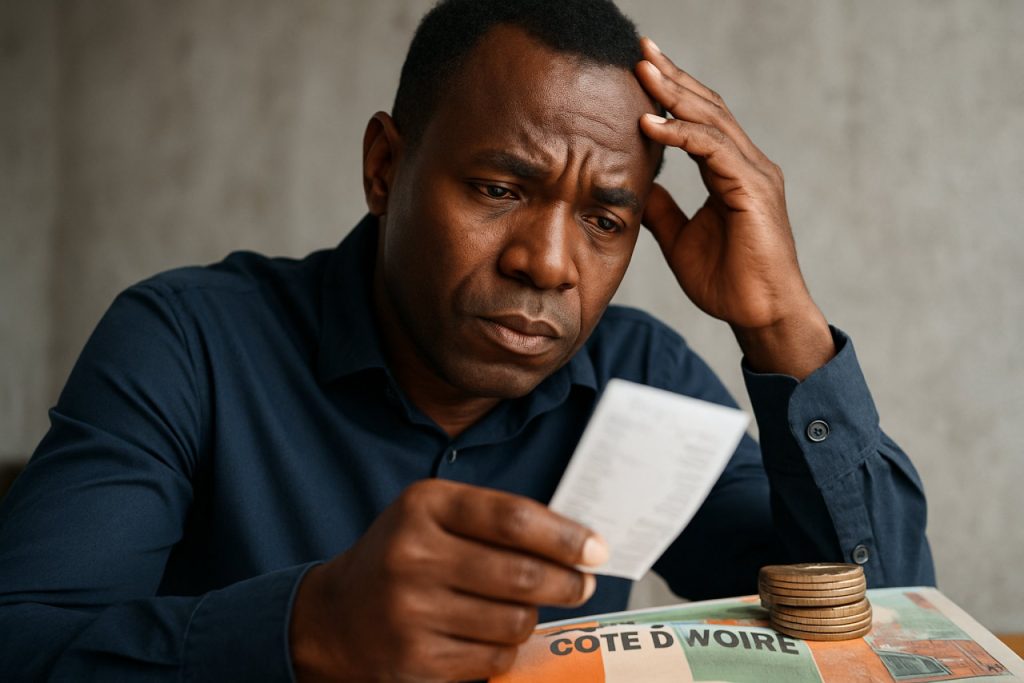

Impact on Households: Cost of Living, Food, and Basic Goods

In recent years, inflation trends in Côte d’Ivoire have had a pronounced impact on households, particularly regarding the cost of living, food prices, and access to basic goods. Following a period of relatively stable inflation, the country experienced a notable uptick in consumer prices starting in 2022, largely driven by external shocks such as global supply chain disruptions, elevated energy costs, and the lingering effects of the COVID-19 pandemic. According to the Institut National de la Statistique (INS), the annual inflation rate reached approximately 5.2% in 2022, a significant increase compared to previous years, with food and non-alcoholic beverages being key contributors to the rise.

The government has responded with several regulatory and fiscal measures to mitigate inflation’s impact on vulnerable populations. In 2023, price ceilings were imposed on essential products such as rice, sugar, cooking oil, and fuel, as outlined in official communiqués from the Ministère du Commerce, de l’Industrie et de la Promotion des PME. These interventions aimed to stabilize prices in urban and rural markets and ensure compliance among retailers. Enforcement mechanisms include fines and temporary closures for non-compliance, as stipulated by the national price control legislation.

Despite these measures, households continue to feel the effects of inflation, particularly in food security. The INS notes that, by mid-2024, food inflation remained above 8%, disproportionately affecting low-income families who spend a large share of their income on staples. The rising cost of basic goods has led to adjustments in household consumption patterns, with many reducing their intake of protein-rich foods and turning to less expensive, carbohydrate-based alternatives.

Looking ahead to 2025 and beyond, the government projects a gradual moderation of inflationary pressures as global commodity prices stabilize and domestic agricultural output recovers. The Ministère de l’Économie et des Finances forecasts overall inflation to decline towards the West African Economic and Monetary Union (WAEMU) convergence target of 3% by 2026, contingent on continued policy discipline and favorable external conditions. However, persistent risks remain, including climate-related disruptions to food supply, regional security issues, and potential global economic volatility. Ongoing vigilance and adaptive policy measures will be critical in safeguarding household purchasing power and ensuring access to essential goods in the years ahead.

Business Implications: Strategic Risks and Opportunities

Côte d’Ivoire’s inflation trends in 2025 present both strategic risks and opportunities for businesses operating in the region. After peaking during the global commodity and supply chain disruptions of 2022–2023, headline inflation has shown signs of moderation but remains above the pre-pandemic average. According to the Institut National de la Statistique (INS), consumer price inflation averaged approximately 4.5% in 2023, driven primarily by food and energy prices. The government, in alignment with the West African Economic and Monetary Union (WAEMU) standards, aims to maintain inflation below the 3% threshold, but persistent external shocks and structural domestic constraints have made this target challenging.

Key legislative and policy responses have included price controls on essential goods and energy subsidies. The Ministry of Commerce, Industry and Promotion of SMEs has issued several regulatory decrees limiting price increases on staple foods and petroleum products to cushion the impact on households and preserve purchasing power (Ministère du Commerce, de l’Industrie et de la Promotion des PME). Compliance with these measures is closely monitored, and non-compliance can lead to fines or temporary closure of businesses, as stipulated in the national consumer protection laws.

From a strategic risk perspective, inflationary pressures can erode profit margins, increase operational costs, and create volatility in demand forecasting. Businesses reliant on imported raw materials face heightened currency and supply chain risks, especially given the CFA franc’s peg to the euro and vulnerability to global commodity price swings. Conversely, sectors such as agriculture and local manufacturing may find opportunities in substituting imports with domestic production, supported by government incentives and industrial policy frameworks.

Looking ahead to 2025 and beyond, the Banque Centrale des États de l'Afrique de l'Ouest (BCEAO) projects a gradual return to the WAEMU inflation target, provided global conditions stabilize and domestic reforms advance. However, climate-related shocks, regional security issues, and global price volatility remain significant downside risks. Businesses are advised to closely monitor monetary policy updates, diversify supplier bases, and consider hedging strategies to mitigate cost pressures. Strategic investment in local value chains may offer resilience and competitive advantage as the government continues to prioritize economic diversification and food security.

Law & Tax: Regulatory and Fiscal Policy Updates from the Ministry of Economy and Finance

In 2025, inflation trends in Côte d’Ivoire continue to be shaped by both domestic policy adjustments and global economic forces. The Ministry of Economy and Finance remains vigilant in monitoring price stability, a key mandate given the country’s strong agricultural sector and ongoing infrastructure investments. According to the most recent data, headline inflation in Côte d’Ivoire is projected to moderate, aligning with the West African Economic and Monetary Union (WAEMU) convergence criteria, which stipulate an annual inflation rate below 3% for member states. As of early 2025, the national inflation rate hovers close to this benchmark, reflecting efforts to ensure macroeconomic stability Ministère de l'Économie et des Finances de Côte d'Ivoire.

Several legislative and regulatory actions underpin these results. In late 2024 and into 2025, the government reinforced price controls on essential goods, particularly foodstuffs and fuel, through targeted subsidies and temporary price ceilings. These interventions are periodically reviewed by the Ministère du Commerce, de l’Industrie et de la Promotion des PME, ensuring compliance with both national law and regional WAEMU regulations. Furthermore, the government has increased support for domestic production and supply chain resilience through fiscal incentives, aiming to buffer the local economy from imported inflationary pressures.

Tax policy has also played a crucial role. The 2025 Finance Law introduced adjustments to VAT rates on selected basic commodities and reduced customs tariffs for certain imports deemed critical to price stability. These changes are implemented in accordance with both national fiscal objectives and compliance standards set by the Direction Générale des Impôts. The government continues to prioritize the harmonization of tax policy with WAEMU guidelines, which contributes to a more predictable inflation outlook.

- Key statistics: National inflation fluctuated between 2.7% and 3.2% in the first quarter of 2025, with food and energy prices being the primary contributors. The Ministry’s projections indicate a gradual decline toward the 2.5% mark by year-end, assuming no major external shocks.

- Compliance: Ongoing monitoring by the Ministry of Economy and Finance ensures that all fiscal and price interventions comply with both domestic legislation and regional requirements from the Banque Centrale des États de l'Afrique de l'Ouest (BCEAO).

Looking ahead, the outlook for 2026 and the following years remains cautiously optimistic. The government’s commitment to prudent fiscal management, targeted subsidies, and enhanced domestic production is expected to maintain inflation within the WAEMU target range. However, vigilance is required, particularly concerning global commodity price volatility and potential supply chain disruptions, which could influence inflationary trends in Côte d’Ivoire.

Compliance: Monetary Policy Actions by BCEAO and Central Bank Mandates

The compliance landscape surrounding inflation control in Côte d’Ivoire is intrinsically linked to the monetary policy actions of the Central Bank of West African States (BCEAO). As a member of the West African Economic and Monetary Union (WAEMU), Côte d’Ivoire’s inflation trends and regulatory responses are shaped by BCEAO’s mandates, which prioritize price stability as a central objective. The BCEAO’s main instruments—policy interest rates, reserve requirements, and open market operations—are deployed uniformly across member countries to anchor inflation expectations and foster macroeconomic stability.

In 2024 and early 2025, the BCEAO has maintained a vigilant stance in response to prevailing inflationary pressures, driven by global supply chain disruptions, energy price volatility, and localized factors such as food price increases. The BCEAO raised its key policy rate (the minimum bid rate for liquidity provision) from 2.5% in 2022 to 3.5% in 2023, holding it steady into 2025, aiming to contain inflation within the WAEMU convergence criterion of less than 3% annual change in the consumer price index (Banque Centrale des États de l'Afrique de l'Ouest). Recent official data indicate that Côte d’Ivoire’s inflation rate averaged approximately 4.2% in 2023, with projections suggesting a gradual moderation toward the 3% target by late 2025 as monetary tightening takes full effect (Institut National de la Statistique de Côte d’Ivoire).

Legally, the BCEAO operates under the Statutes of the WAEMU, which require all member states—including Côte d’Ivoire—to comply with union-wide directives on monetary and financial stability (Banque Centrale des États de l'Afrique de l'Ouest). Compliance is monitored through regular reporting and assessments at both the national and union level. The Ivorian government, via its Ministry of Economy and Finance and the local BCEAO branch, is responsible for implementing policy measures and ensuring alignment with the central bank’s anti-inflationary stance.

- 2023 inflation in Côte d’Ivoire: ~4.2% year-on-year

- BCEAO policy rate: 3.5% (as of Q1 2025)

- WAEMU convergence criterion for inflation: <3%

Looking forward, the inflation outlook for Côte d’Ivoire hinges on BCEAO’s commitment to policy discipline and member state compliance. Expected improvements in supply chains and food production, alongside continued monetary tightening, should support a return to target inflation levels by 2026. However, external shocks, fiscal slippages, or non-compliance with union rules could challenge this trajectory. Ongoing coordination between BCEAO and national authorities remains essential for effective inflation management and economic stability.

Key Statistics: GDP, CPI, and Inflation Benchmarks (Official Sources)

Côte d’Ivoire’s inflation trajectory has been shaped by both internal reforms and external shocks, with official sources highlighting efforts to maintain macroeconomic stability. In the context of the West African Economic and Monetary Union (WAEMU), of which Côte d’Ivoire is a key member, the inflation benchmark is set at a maximum of 3% annually, as stipulated in convergence criteria for all member states (Banque Centrale des États de l’Afrique de l’Ouest).

According to the Institut National de la Statistique de Côte d’Ivoire, the national Consumer Price Index (CPI) reflected a year-on-year inflation rate of 4.2% in 2023, peaking due to lingering effects of global commodity price increases and supply chain disruptions. Preliminary data for early 2024 indicate a modest deceleration, with inflation rates hovering around 3.7%, aided by improved harvests and government interventions to stabilize key food prices. The Ministry of Economy and Finance projects that, barring major external shocks, the inflation rate will gradually return closer to the WAEMU convergence ceiling in 2025, with a target range of 2.5%–3.0% (Ministère de l’Économie et des Finances).

Real Gross Domestic Product (GDP) growth has remained robust, with official estimates citing a 6.4% expansion in 2023, driven by agriculture, construction, and services. The outlook for 2025 suggests a continuation of this trend, albeit potentially moderated by tighter monetary policy aimed at reining in inflation (Banque Centrale des États de l’Afrique de l’Ouest). The government’s inflation control measures include price monitoring, subsidies for basic goods, and targeted fiscal support for vulnerable groups.

- WAEMU inflation benchmark: 3% annual ceiling

- 2023 CPI inflation (Côte d’Ivoire): 4.2%

- 2024 CPI inflation (early estimate): 3.7%

- 2025 inflation target: 2.5%–3.0%

- Real GDP growth (2023): 6.4%

With the regional central bank’s commitment to monetary stability and ongoing government interventions, Côte d’Ivoire’s inflation is expected to moderate in 2025. However, policymakers remain vigilant regarding global commodity price volatility and regional security concerns, which could impact both inflation and overall economic performance.

Future Outlook: 2026–2030 Scenarios and Policy Recommendations

Inflation dynamics in Côte d’Ivoire have been shaped by global and regional developments, as well as domestic fiscal and monetary policies. As of 2025, the country continues to experience moderate inflation rates compared to the early 2020s, when pandemic-related supply shocks and global commodity price volatility resulted in temporary surges. The annual inflation rate for Côte d’Ivoire was estimated at approximately 3.5% in 2024, aligning with the convergence criteria set by the West African Economic and Monetary Union (WAEMU), which caps member states’ inflation at 3% for macroeconomic stability Banque Centrale des États de l'Afrique de l'Ouest.

Recent events influencing inflation include fluctuations in global food and energy prices, disruptions in regional trade corridors, and currency stability due to the CFA franc’s euro peg. The government has responded through a combination of fiscal measures—such as targeted subsidies and price controls on key staples—and monetary policy coordination within WAEMU. Legislative measures, such as the Finance Law 2024, have prioritized food security and support for vulnerable households to cushion the impact of imported inflation Ministère de l’Economie et des Finances.

Compliance with WAEMU’s macroeconomic convergence framework remains a guiding principle for Côte d’Ivoire’s inflation management. The country has consistently submitted macroeconomic and budgetary data to the union’s surveillance bodies, ensuring alignment with prescribed fiscal deficits and debt levels Union Economique et Monétaire Ouest Africaine.

Looking ahead to 2026–2030, several scenarios are possible. If global commodity prices stabilize and domestic reforms continue, inflation is projected to remain within or near the WAEMU target range, underpinned by sustained agricultural output and gradual diversification of the economy. However, downside risks persist, including external shocks, climate variability affecting food production, and potential currency volatility should there be any revision of the CFA franc’s arrangement.

- Scenario 1: Continued macroeconomic discipline keeps inflation at 2.5–3.5%, supporting real income growth and investor confidence.

- Scenario 2: Adverse external shocks or domestic supply constraints push inflation above 4%, prompting tighter fiscal and monetary responses.

- Policy Recommendations: Enhance agricultural productivity, strengthen social protection for food security, and maintain compliance with union convergence criteria. Regularly review fiscal incentives and refine monetary tools to pre-empt inflation spikes.

In summary, Côte d’Ivoire’s inflation outlook for 2026–2030 will depend on prudent policy implementation, regional cooperation, and adaptive responses to both domestic and global risks.