Syria’s economic recovery is as crucial as rebuilding its infrastructure, with revenue enforcement playing a pivotal role....

David Farrow

David Farrow is an accomplished writer and thought leader specializing in new technologies and financial technology (fintech). He holds a Master's degree in Business Administration from Harvard University, where he developed a keen interest in the transformative power of technology in finance. With over a decade of experience in the industry, David has worked at Techlith, a leading technology consultancy, where he contributed to pioneering projects that integrate digital innovations into traditional financial services. His insights and analyses have been featured in numerous publications, earning him recognition as a trustworthy voice in the fintech community. David's mission is to inform and educate readers about the evolving landscape of technology and its implications for the future of finance.

The Foreign Tax Credit (FTC) in Tunisia offers a financial relief mechanism, allowing residents to offset foreign...

Grenada offers a unique blend of natural beauty and financial benefits, attracting investors and expatriates seeking tax...

Norway’s renewable energy sector is significantly shaped by legal counsel, ensuring projects like wind and hydroelectric power...

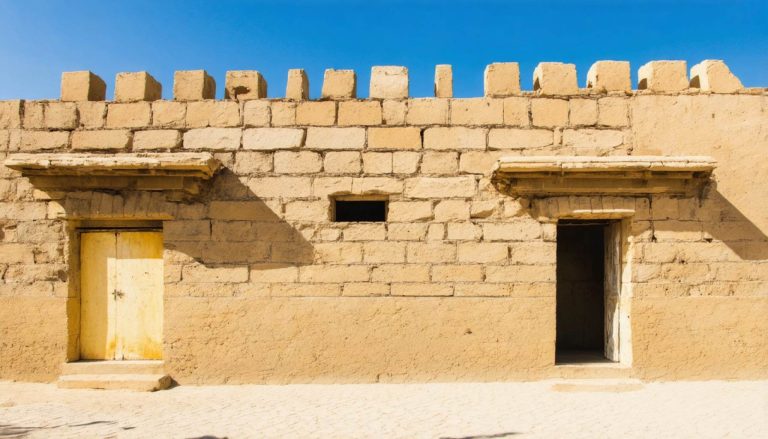

Egyptian contract law blends ancient wisdom with modern practices, reflecting a fusion of Islamic and Napoleonic influences...

Tax exemptions have transformed Senegal’s agricultural sector, providing essential financial relief on inputs like seeds, fertilizers, and...

Micronesia’s minimum wage debate highlights the tension between traditional subsistence and modern economic demands. Current minimum wage...

Enforceable contracts underpin Nepal’s growing commerce, similar to the cultural strength of the Himalayas. Key elements of...

The Tax Identification Number (TIN) is crucial for streamlining business operations and ensuring tax compliance in Rwanda’s...

Insider trading is illegal in Bulgaria, with strict laws enforced by the Financial Supervision Commission. These laws...