Havana’s vibrant allure masks a complex dance of regulations requiring expert navigation by tax attorneys. Cuba’s unique...

Argentina’s insolvency law serves as a vital framework aimed at rehabilitating businesses and preserving jobs in times...

Zambia is implementing an innovative environmental tax to promote sustainability and economic resilience. The tax targets industries...

Italian retirement contributions offer a unique tax deduction benefit, reducing taxable income up to 5,164.57 euros annually....

Educational funding is primarily derived from local property taxes, causing disparities between wealthy and underserved districts. Fiscal...

Latvia’s gift tax system differentiates between taxable and non-taxable gifts, crucial for financial peace of mind. Gifts...

Lahore’s local court serves as a microcosm of Pakistan’s intricate legal landscape, playing a crucial yet underappreciated...

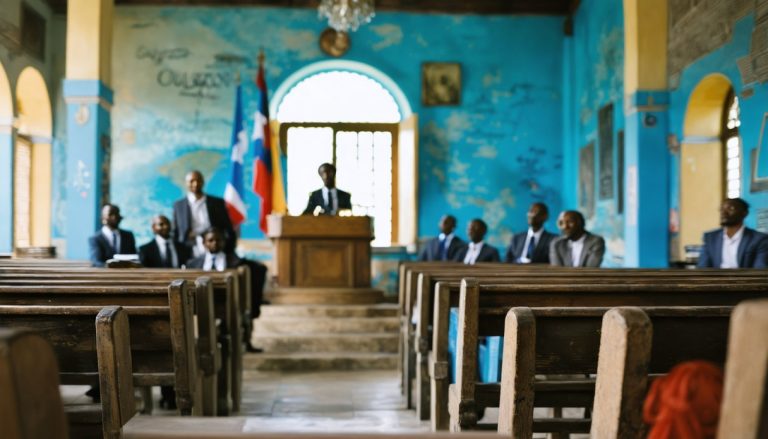

Egypt’s legal system blends historic and modern influences, rooted in both French civil law and Islamic traditions....

Lao trademark law plays a crucial role in safeguarding both brands and consumers, particularly in a marketplace...

Japan’s tax system is a carefully structured, progressive framework with national income tax rates ranging from 5%...